Settling Your Home Equity Investment with a Loan or HELOC

Thinking about settling your Hometap Investment with a home equity loan or line or credit? Knowing your options and the steps involved with each is a critical first part of the planning process, ensuring that you make the best decision possible — and many homeowners find that a home equity loan or line of credit is the right option for them.

Before we get into the steps for settling your investment, it’s important that you understand the nuances between these two financial products.

A home equity loan is a method of accessing equity that provides you with cash up front, along with a fixed interest rate and predictable monthly payments. However, you’ll have to pay off the loan alongside your mortgage payments and the application and approval processes can have strict requirements.

A home equity line of credit (HELOC) is a flexible financing option that allows you to draw funds from your equity over time, similar to a credit card. You only pay interest on the amount you’ve drawn, but HELOC interest rates are variable, meaning your payments may differ from month to month. Like a home equity loan, the process for application and approval can be strict. Also keep in mind that if your credit score decreases too much, lenders can freeze your account at any time.

No matter which settlement method you choose, our Investment Support team is here to ensure the process is as smooth and transparent as possible.

3 Things to Consider Before Settling

Whether you’re settling your Investment with a home equity loan or HELOC, keep these 3 things in mind. It’s important to pick the settlement option best suited to your needs and circumstances.

- Timeframe: Consider how close you are to the end of the 10-year effective period of your Hometap Investment. We recommend beginning the settlement process at least 45 days before the end of the effective period to ensure enough time. You should also think about your timeline if you’re up against the end of your Investment’s 10-year effective period. (If you plan to settle at the end of the ten year term, you can find your settlement date by selecting the Settlement Calculator in your account.)

- Costs/fees: There are costs associated with a home equity loan or line of credit. Before finalizing your decision, make sure you understand all the details that come with your chosen option.

- Other options: Ensure that you’ve explored all other options available to you. There may be an alternative settlement method that’s a better fit for you.

- Home sale: If you don’t plan to remain in your home, selling it may be the best choice, since you’ll use the proceeds of the home sale to settle.

- Cash-out refinance: You can also settle your Investment by refinancing your mortgage. A cash-out refinance involves replacing your current mortgage loan with a larger one, allowing you to get the difference between the two in cash. This can be a good option if you’re able to lower your interest rate with the new mortgage.

- Buyout with savings: If you have enough savings built up to buy out Hometap’s share of your home, this may be the way to go since it doesn’t involve adding a new debt.

Determine What You Owe

Once you’ve decided to settle your Investment, the first step is to determine approximately how much you owe; this amount is also known as the Hometap Share. The easiest way to confirm your estimated balance is by logging into your Hometap account and using our Settlement Calculator.

Initiating Your Settlement

After you’ve reviewed all your options, picked the best fit, and applied for funding, it’s time to initiate the settlement process. Start by reaching out to our Investment Support team at homeowners@hometap.com or calling +1 (617) 604-6985. When doing so, provide the following information:

- A good-through date for your Settlement Statement — this should be at least 30 days out.

- The method of settlement — in this case, a home equity loan or HELOC.

From there, we’ll determine the current fair market value (FMV) of the property using an automated valuation model (AVM) and the Investment Support team will share your final payoff amount with you via email. This email will also include directions for how to submit your payment, so make sure to read it closely.

Completing Your Settlement

Once you’ve received the funds from your home equity loan or HELOC, the next step is to pay off the Hometap Share. There are 4 payment methods we accept that will allow you to complete your settlement:

- A wire transfer is an electronic method for sending money, and can be completed at a bank or cash office. This is often the preferred choice for homeowners because it’s the quickest.

- A certified check is a check drawn from your personal funds that is guaranteed by a bank after they confirm you have a sufficient amount of money.

- A cashier’s check is also guaranteed by a bank, but in this case, the bank takes the funds, holds them in escrow, and prints a check against those funds.

- A money order is a secure way to send a payment up to $1,000, so this is an option only if you have a settlement amount under $1,000. Money orders also won’t bounce and have a quick timeline.

After you’ve submitted payment via your chosen method, a member of Investment Support will contact you confirming receipt of the funds. Next, we will file to remove the lien Hometap placed on your property at the time of the Investment. Typically, it takes 7-30 days for the lien to be released.

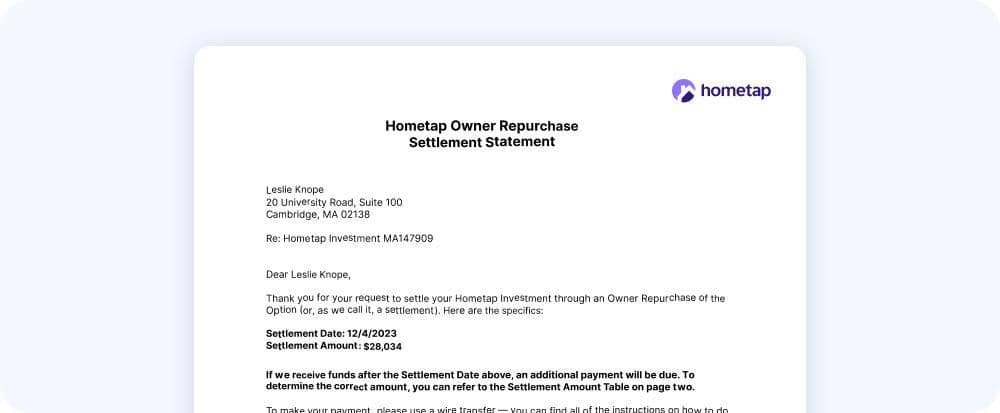

Keep an eye out for a letter from Hometap indicating that the funds were received and your Investment has been settled. Below, you’ll find an example of what this letter looks like.

We aim for the settlement process to feel as seamless as your initial investment process. In summary, here’s what that entails:

After the Investment

Even after you settle your Hometap Investment, you still have free access to your Home Equity Dashboard (HED). Your Dashboard is always at your fingertips, ready to help you protect and grow your home’s value and equity throughout your homeownership journey.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

Related Tags:

Home equity loanMore in “Manage your Investment”

What Happens If You Don't Pay Property Taxes? A Guide for Homeowners

Understanding Your Hometap Quarterly Statement