Mortgage Forbearance: How it Works and Your Options

This page was last updated on June 5, 2025

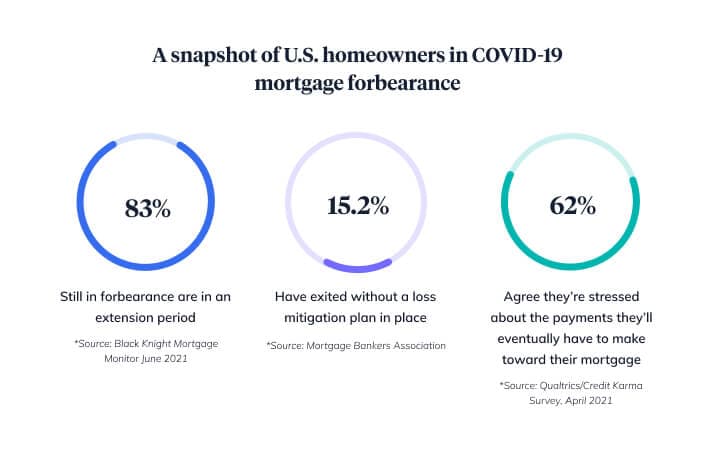

If you’re not entirely sure how your COVID-19 mortgage forbearance works, when it ends, what you’ll do when it ends, or how it impacts your finances in the long run, you’re not alone. More than 7.3 million American homeowners have entered into mortgage forbearance since the start of the COVID-19 pandemic, and as of August 2021, nearly 2 million were still in forbearance programs and likely thinking about their exit plan — leaving many of them asking, now what?

The following article will help you understand what you need to know about COVID-related mortgage forbearance, whether you’re looking to extend it, exit it, or get back on track financially after it. Here’s what we’ll cover (click on any of the following bullets to jump to a particular section):

- Understanding Mortgage Forbearance

- The CARES Act

- Types of Forbearance

- Forbearance Repayment Plans

- Forbearance Extensions

- Multifamily Forbearance Programs

- Exiting Forbearance

- Getting Back on Track after Exiting Forbearance

- Frequently Asked Questions

- Helpful Resources

Understanding Mortgage Forbearance

Mortgage forbearance is an agreement between you and your lender that allows you to make lower payments or suspend payment on a temporary basis until you’re in a better place financially. It typically doesn’t affect your credit score in the same way a foreclosure does, as long as you were current on your mortgage prior to the established forbearance period.

Although mortgage forbearance existed before, the global COVID-19 pandemic triggered new forbearance opportunities for U.S. homeowners due to the hardships that the pandemic caused.

The specifics of your forbearance agreement depend on your particular lender, but the terms will likely address issues including your payment amount during forbearance, how long the relief will last, the method and time frame for repayment, and whether or not the lender will report your forbearance status to credit bureaus.

Forbearance is not loan forgiveness, and should never be considered a “free ride” — you’re required to make up for the missed payments. Any interest that your loan accrues under normal circumstances will continue to do so throughout your relief program as well. You’ll still receive monthly statements from your lender.

The CARES Act

The CARES Act is a piece of federal legislation signed into law in March of 2020 as a direct result of the COVID-19 pandemic. It stands for Coronavirus Aid, Relief, and Economic Security Act, and it entails the $2.2 trillion economic stimulus bill to aid the fallout caused by the pandemic and subsequent events. As it pertains to mortgage forbearance, government-backed mortgages are covered under this act, but privately-held mortgage loans are not. This means that the private lenders are the ones covering the costs of forbearance, so their parameters, timelines, and qualifications may differ from government-backed loans.

Types of Loan Forbearance

There are several different types of mortgage relief assistance, depending on your specific loan, but they usually fall into two buckets:

- A complete deferment of payments

- A significantly reduced amount every month during a set time frame (typically no longer than one year)

The terms of your forbearance will also depend on whether your mortgage is government-backed, privately funded by a bank, and/or is related to COVID-19-unique forbearance opportunities. If you’re not sure whether your mortgage loan is government backed or not, you have a few ways of finding out. The most direct way is to contact your servicer directly. Your mortgage statement will indicate who your servicer is and should provide a contact number for you to call. You can also check online to see if your mortgage is backed by Fannie Mae or Freddie Mac.

Forbearance Repayment Options

Homeowners are responsible for contacting their lender to find out how they’ll repay their missed payments and get their mortgage back on track. Repayment plans are done on an individual basis. In other words, there is no cookie-cutter approach that works for all homeowners and the options vary by lender as well.

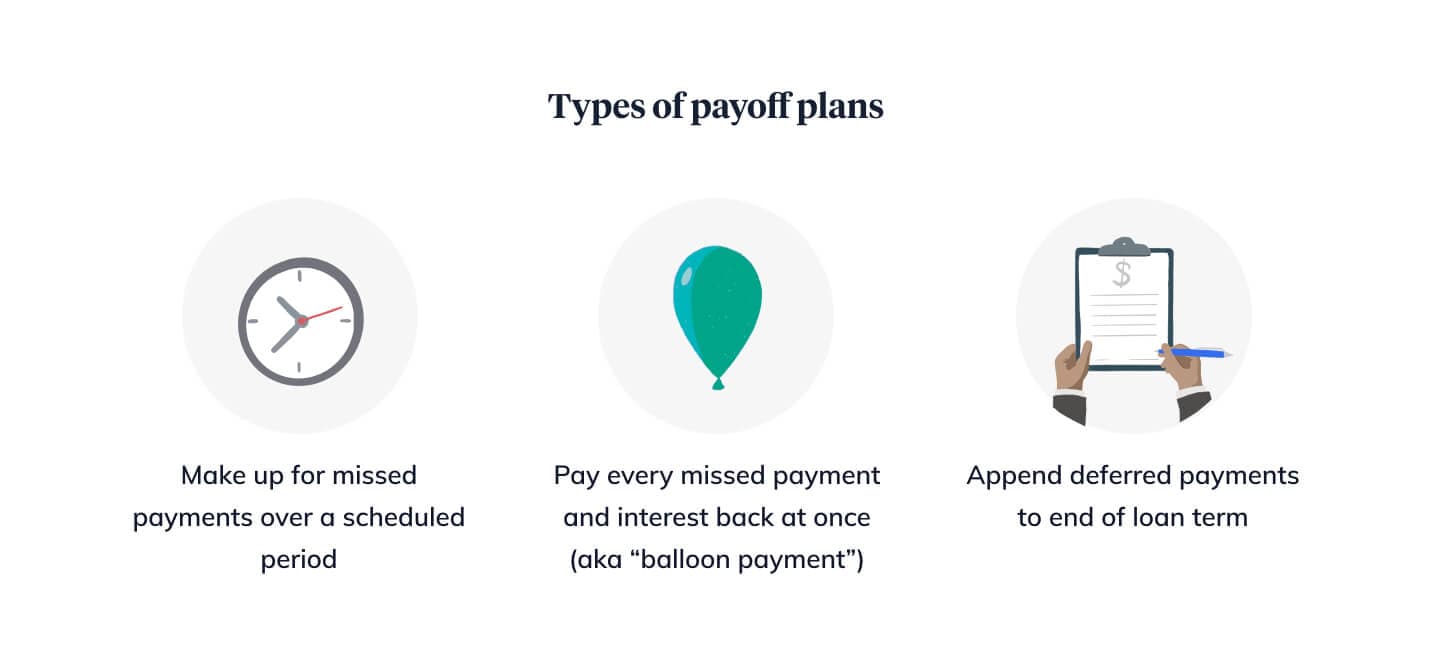

The most common method is a repayment schedule that staggers your skipped payments over an established period of time that you agree upon with your mortgage provider. For example, with Fannie Mae, Freddie Mac, FHA, or HUD loans, you might pay a slightly higher monthly bill when you exit forbearance. Your bill will then typically go back to its original amount once the debt is fully paid off.

It’s not as common, but reinstatement allows you to pay everything back at the same time in a lump sum if you’re able — this is often referred to as a balloon payment. The advantage here is that you take care of the installments you missed in one fell swoop and can quickly get back on track with your regular mortgage payments, if the lump sum payment is something you’re able to handle. This payment structure is more common with private lenders and banks.

A third possible option is to append the total you owe onto the end of your mortgage term. One benefit of this route is that it can postpone the need to pay a significant amount of money until several years down the road. If you still have ten years left on your mortgage, for example, you’re making all of the missed payments in year ten.

For those homeowners who choose to modify their loan, some will be responsible for proving they can make three on-time payments before their loan can be officially modified and recorded. This may also be the case for those looking to refinance. Of course, there are factors that can make a homeowner ineligible for a refinance or other loan modification, such as credit score or loan-to-value ratio.

If you discover you are required to make a lump sum payment, that your new monthly payment is higher than you can comfortably afford, or simply want to address your forbearance quickly, you may want to consider other options.

First, you might be able to take advantage of the current housing market and sell your home, downsizing to a home that allows you to get your finances back on track.

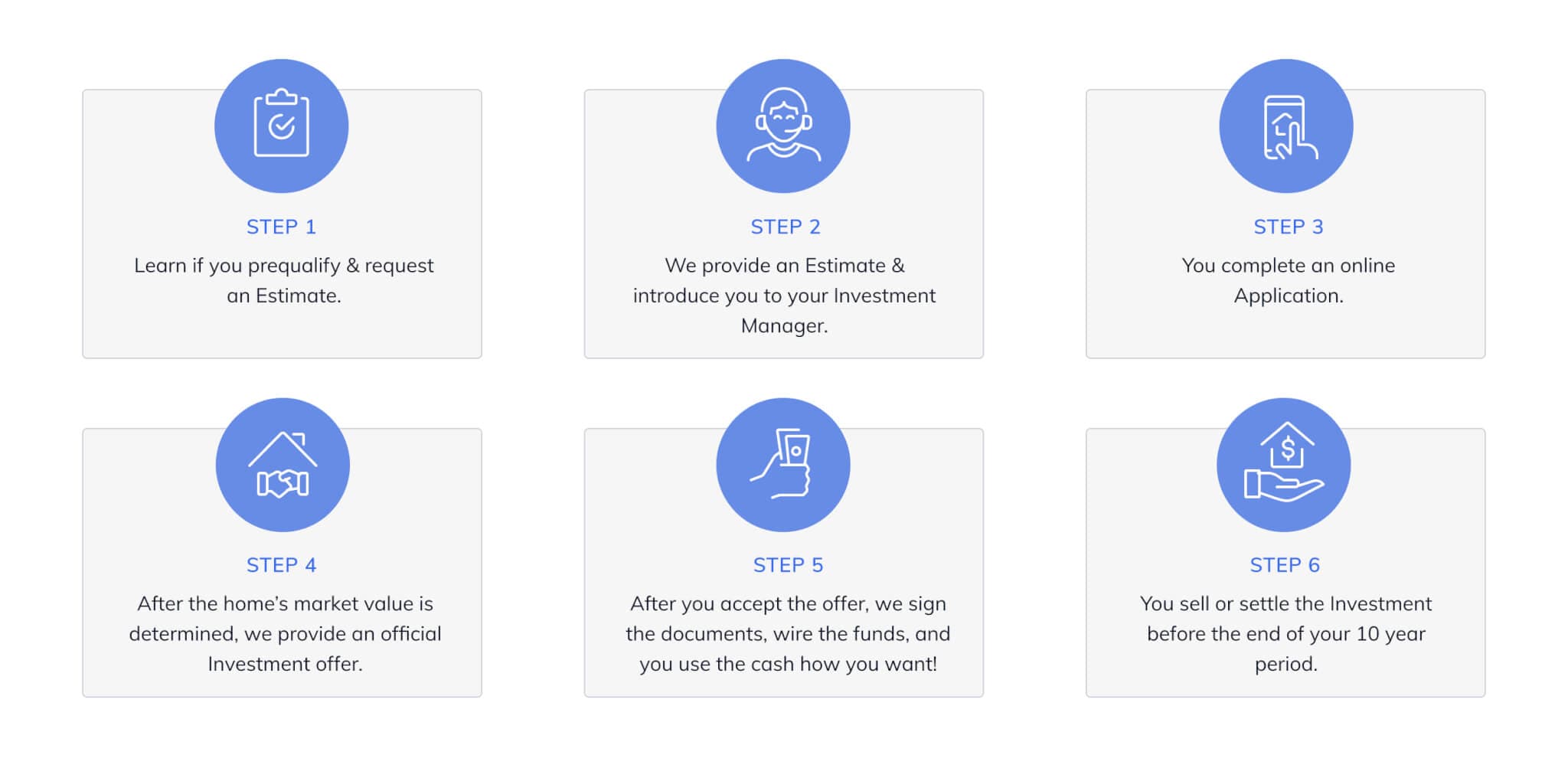

A second option worth considering if you have at least 25% equity in your home is a home equity investment, which allows qualifying homeowners to receive as much as 25% of their home value in cash with no obligations as to how the money is spent. This option can be a good fit for some homeowners because it doesn’t have any interest impact to DTI or monthly payments. Instead, the homeowner settles the investment at the end of the effective period (typically 10-30 years), and what is owed to the investor is an agreed-upon percentage of the home’s market value at the time of settlement.

The terms for each home equity investment provider are unique. Here’s how it works with Hometap Home Equity Investments:

Request an Estimate risk-free to find out if your property qualifies and how much of your equity you could receive in cash.

Forbearance Extensions

You may be able to request an extension from your lender if you need more time. The length of the extension depends on your lender.

If you have a mortgage backed by Fannie Mae or Freddie Mac and have entered a COVID-19 related forbearance, you may be allowed to request up to two additional three-month extensions, for a maximum of 18 months of total forbearance. But to be eligible, you must have been in an active COVID-19 related forbearance plan as of February 28, 2021.

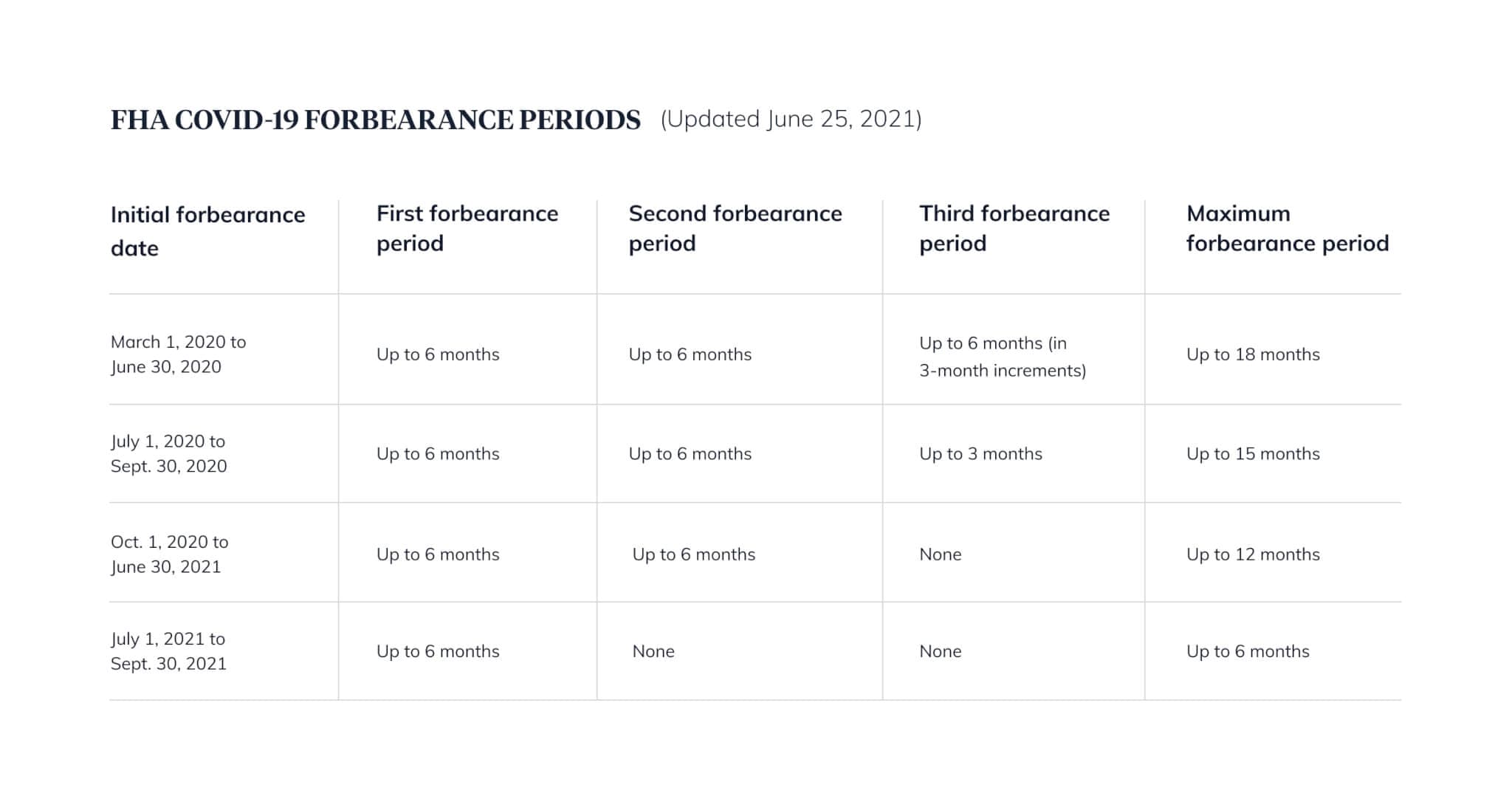

Mortgages backed by FHA, VA, and USDA offer the same extensions for COVID-19 related forbearance plans. However, you must have requested an initial forbearance plan on or before June 30, 2020 to be eligible. For example, an FHA mortgage loan forbearance timeline will look like the following:

For extension dates under privately-held mortgage loans, you’ll need to check with your servicer for more information.

Multifamily Forbearance Programs

Multifamily forbearance programs and their terms will also vary by lender.

Borrowers who have a federally-backed mortgage on a multi-family property, can request a COVID-related forbearance agreement until September 30, 2021. Be aware that these programs come with responsibilities to tenants. For example, borrowers are responsible for notifying their tenants in writing of renter protections, including a moratorium on evictions based solely on nonpayment during the forbearance period and a 30-day notice for evictions for other reasons. Tenants must be informed that they can pay unpaid rent over a period of time, need not pay in a lump sum, and borrowers can’t charge tenants late fees, penalties, or other charges due to not paying rent during the forbearance or repayment period.

Borrowers are required to show hardship to qualify for the multifamily forbearance program.

Private-label commercial mortgage-backed security servicers are generally not offering broad relief to borrowers. Instead, requests are being evaluated and addressed on a case-by-case basis.

Exiting Forbearance

What happens at the end of forbearance is dependent on you and your lender. When you’re ready to end your forbearance or when your time period is up, you should contact your servicer to discuss your repayment options.

When speaking with your servicer, make sure you get answers to the following:

- What is the date on which your forbearance ends?

- Are you eligible for an extension?

- What are your repayment options?

- If a lump sum payment is required, can this be appended to the end of your mortgage term?

For government-backed mortgage loans, qualified homeowners likely have the option of choosing to append the lump sum to the end of their mortgage term, to opt for a short-term repayment period, to request a loan modification such as a longer term or better rate, or to sell their home. Because of the CARES Act, these programs offer new ways to assist homeowners with exiting COVID-19 forbearance:

The Federal Housing Administration (FHA) has developed the COVID-19 Standalone Partial Claim to assist with repayment if a homeowner can’t resume making mortgage payments. A partial claim is a zero-interest, zero-fee, junior lien on a homeowner’s property that will become payable when the homeowner either sells the home, pays off the mortgage, or the mortgage otherwise terminates. The FHA offers other forms of assistance for homeowners that don’t qualify for the Standalone Partial Claim.

For USDA mortgage loans, the FHA will offer new options to help borrowers attain a 20% reduction in their payments. These options may include an interest rate reduction, term extension and a mortgage recovery advance, to help cover past due mortgage payments and/or related costs.

For VA mortgage loans, borrowers are able to reduce their monthly payments, and the U.S. Department of Veterans Affairs can purchase up to 30% of borrowers’ unpaid principal balance and arrearages and provide an interest-free subordinate loan similar to a partial claim. Servicers can also extend the loan term to up to 40 years.

If you have a privately-held mortgage, it’s recommended to contact your servicer to discuss your options. You will find the contact information for your loan servicer at the top of your mortgage statement. Many private banks offer programs very similar to those under the CARES Act, and they may refer you to a HUD housing counselor to further discuss your options. You may also find that your state offers its own assistance program.

Getting Back on Track After Exiting Forbearance

Regardless of whether you’ve chosen an incrementally larger monthly payment or a balloon payment to end your forbearance program, you may find yourself struggling to return your finances to their normal, pre-pandemic state.

The good news is, depending on your personal circumstances, that you may have options to consider when putting a recovery plan in place if you need access to some additional cash.

Home Equity Loan: With a home equity loan, homeowners who qualify can receive a lump sum payment and fixed interest rate, providing a predictable monthly payment and the means to pay off any outstanding debt.

Home Equity Line of Credit (HELOC): Homeowners who qualify can access as much as 90% of their home’s value with a line of credit, and have the ability to access it on an as-needed basis.

Home Equity Investment: A home equity investment may allow you to access up to 25% of your home value in cash with no monthly payments. And with a ten-year effective period, qualified homeowners have the time they need to get finances in order before needing a settlement plan in place. If you’re a homeowner that’s already received a Hometap Investment but didn’t receive the maximum investment, you can do what’s called an Investment Increase and request a second Investment.

Cash-out refinance: Many homeowners that qualify for a cash-out refinance are able to secure a lower rate and receive cash by replacing their existing mortgage for a new one. This of course resets the payment timeline, but can give the homeowners the cash they need to pay off any outstanding debt.

If you’re trying to recover financially without the help of a financial product, it’s worth taking a hard look at your expenses and finding areas to trim the fat and build up your emergency fund so that the next unexpected expense doesn’t set you back again.

An eye-opening exercise that can be helpful is taking a look at each of your debts side by side to understand which ones carry the highest interest and will take the longest to pay off. Our debt calculator is designed to help you see each of your debts side by side.

Frequently Asked Questions

Can I still make payments while in forbearance?

Yes, typically homeowners may pay all, some, or none of their payments while in forbearance. If you’re able to make payments, it’s a good idea to do so to lessen your own burden when it comes time to pay it back.

Is it too late to request COVID-19-related forbearance?

This depends on your servicer and/or loan types. Below is a list of deadlines for different loan types. Keep these deadlines in mind for extensions, as the deadline for extensions will be based on your original forbearance period.

- Fannie Mae and Freddie Mac-backed mortgages have not announced deadlines, so homeowners may still be eligible to apply through their servicer.

- FHA deadline: September 30, 2021

- USDA deadline: September 30, 2021

- VA deadline: September 30, 2021

Privately-held mortgages will determine their own deadlines. Check with your servicer for more information.

How do I know if I qualify for mortgage forbearance?

If you have a government-backed mortgage, you do not need any documentation to prove that you are suffering financial hardship as a result of the pandemic, and therefore you qualify for mortgage forbearance under the CARES Act.

If your mortgage is not government-backed, you will need to contact your servicer to determine if you qualify for their forbearance or deferment program, as they will have their own qualification criteria.

Will mortgage forbearance hurt my credit?

Entering into mortgage forbearance as a result of COVID-19 cannot be reported negatively to the credit bureaus by lenders. However, missing a payment without being part of the program might hurt your credit — another reason to contact your lender if you’re struggling to make payments. Mortgage loan modification as part of a forbearance exit may also affect your credit score.

What is loan modification?

Loan modification is an agreement between the homeowner and the lender to change the terms of a homeowner’s mortgage loan, and typically takes place when the homeowner is unable to keep up with payments. The most common modifications are lowering the monthly payment amount and extending the term timeline so that the homeowner can make smaller payments over a longer period of time.

Modification can also include switching from an adjustable-rate mortgage to a fixed-rate mortgage and rolling late fees into your principal payment. Modification does not include a refinance, since a refinance replaces an existing loan, and a modification entails a change to the original loan terms.

What is a partial claim?

As it pertains to mortgage forbearance, a partial claim defers the repayment of mortgage principal through an interest-free subordinate mortgage that is not due until the first mortgage is paid off. This gives the homeowner a permanently lower mortgage payment to prevent or reinstate a delinquent loan. A partial claim is a common loan modification option for homeowners exiting forbearance.

Can Hometap make Investments with homeowners in forbearance?

Homeowners in forbearance on a mortgage loan may qualify for a Hometap Investment. Some homeowners even use Hometap to exit forbearance by accessing their equity to compensate for the missed payments.

A Hometap Investment may help you get closer to reaching your financial goals in a couple different ways, whether it’s by getting you the cash you need to pay off outstanding debt and resume your mortgage payments, or using that money toward the payments themselves.

The first step is to request an estimate to determine if your property pre-qualifies.

A Hometap Investment could be a good fit if…

- You have at least 25% equity in your home

- You’re required to or prefer to pay your missed payments back in a lump sum

- You’re looking to decrease the total debt owed on your home

- You’ve incurred additional debt during the pandemic, such as student loans or credit card debt

- You will/do struggle to make your mortgage payment after exiting forbearance

- You don’t want to sell your home in order to financially recover

- You don’t want to rely on savings or retirement money in order to financially recover

Important Resources

Consumer Finances Protection Bureau – Coronavirus Help

U.S. Department of Housing and Urban Development-approved counseling agencies

U.S. Department of Housing and Urban Development

Federal Housing Finance Agency – COVID-19 Resources

PreventLoanScams.org

File a Complaint with the CFPB

National Consumer Law Center

The Online FHA Resource Center

Fannie Mae

Summary

- Loan forbearance is not forgiveness. You will be required to make your missed payments, including interest, for the period that your loan was in forbearance.

- If you have a government-backed mortgage, your lender cannot ask for proof of hardship for a COVID-19-related forbearance.

- You must request forbearance (and an extension); it is not automatic.

- You are responsible for contacting your lender to find out how you’ll repay your forbearance and get back on track.

- You are allowed to make payments (partial or full) while in forbearance.

- Make sure to keep a copy of any and all documentation you receive from your lender.

- Keep an eye on your monthly statements to make sure the payment amount, if any, is correct.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.