How Your Home Equity Impacts Financial Aid For College

So your child got into their dream school. Congrats! They’re happy, you’re happy, years of hard work have finally paid off. Then you review the financial aid package and—cue cold sweat—they expect you to pay how much?

With the cost of college rising faster than financial aid awards, many parents and students are facing the seemingly impossible choice of taking on massive debt or forgoing a dream school for a lower-cost option. And, as it turns out, your home equity could be a factor.

What does my 3-bedroom have to do with a degree?

First the good news: not all schools take your home equity into account when calculating aid. If your child chose a school that only requires the FAFSA form, your equity won’t count against you. But, if they hope to attend one of the roughly 200 schools that also require the CSS profile, it’s almost certain some percentage of your home equity will be factored into financial aid.

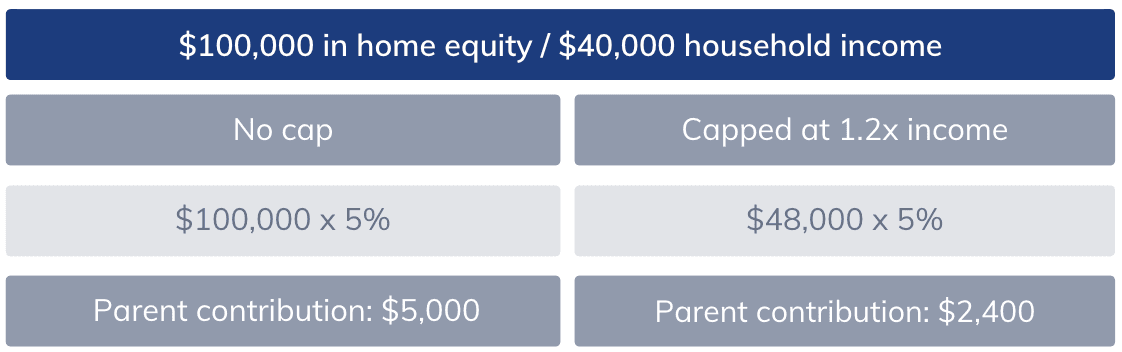

Exactly how much is hard to say. Some schools take 100% of your equity into account, while others cap it based on income. Either way, it could lower your aid package.

Let’s say you have $100,000 in equity. Parent assets are assessed at 5% in the CSS profile, so that would raise your expected contribution by about $5,000.

Okay. But cashing in on my home equity isn’t so simple.

This practice assumes parents are tapping into their home equity to help fund college tuition—which isn’t always the case.

One reason for this is lingering anxiety over the recession. Home Equity Lines of Credit (HELOCs), a once-popular type of loan used to fund education, have fallen by almost half in the past decade despite overall equity growth.

Selling is another option, but for most families it’s not a realistic one. After all, you need a place to live (and we’re pretty sure your child won’t appreciate it if you move into the dorm with them).

So, what CAN I do?

Short of withdrawing your child’s application from schools that require the CSS profile, there’s not much you can do about your home equity being factored into financial aid. But there are ways to turn your home’s equity into cash.

Some parents opt for a cash-out refinancing—when you take out a mortgage for a larger amount than the existing loan in order to get cash back. Today’s comparatively low interest rates make this more attractive than HELOCs, though, naturally, this increases your debt.

Another option is a home equity investment. An investor provides cash in exchange for a share of the future value of your home. This allows you to tap into your equity without monthly payments. And when the time finally comes to drop your new college student off at the dorm, do it knowing you’ve made the best financial decision for you and your family.

See if you prequalify for a Hometap investment in less than 30 seconds.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Financial goals”

Can You Afford Your Mortgage on a Single Income? A Guide for Life's Transitions

The Complete Costs of Buying and Selling a Home