70% of Boston Homeowners Say Home Costs Outpacing Incomes

With equity built up in their homes but little to no cash on hand for more immediate expenses, 79 percent of Boston-area homeowners feel house rich and cash poor, and 22 percent of those feel this way most or all of the time, according to a recent Hometap study of Boston-area homeowners.

Massachusetts ranks No. 5 on the list of costliest monthly mortgages in the U.S., at $1,333 on average. It also comes in at No. 5 on Porch’s list of highest annual home maintenance costs, averaging $17,461.

It’s no wonder, then, that the top stressor for Boston homeowners, based on our survey results, is the cost of home maintenance. Eighty-one percent of those surveyed answered that they’re moderately to extremely stressed when factoring this potential cost into the big picture of homeownership.

What’s the True Cause of the Stress Behind Homeownership?

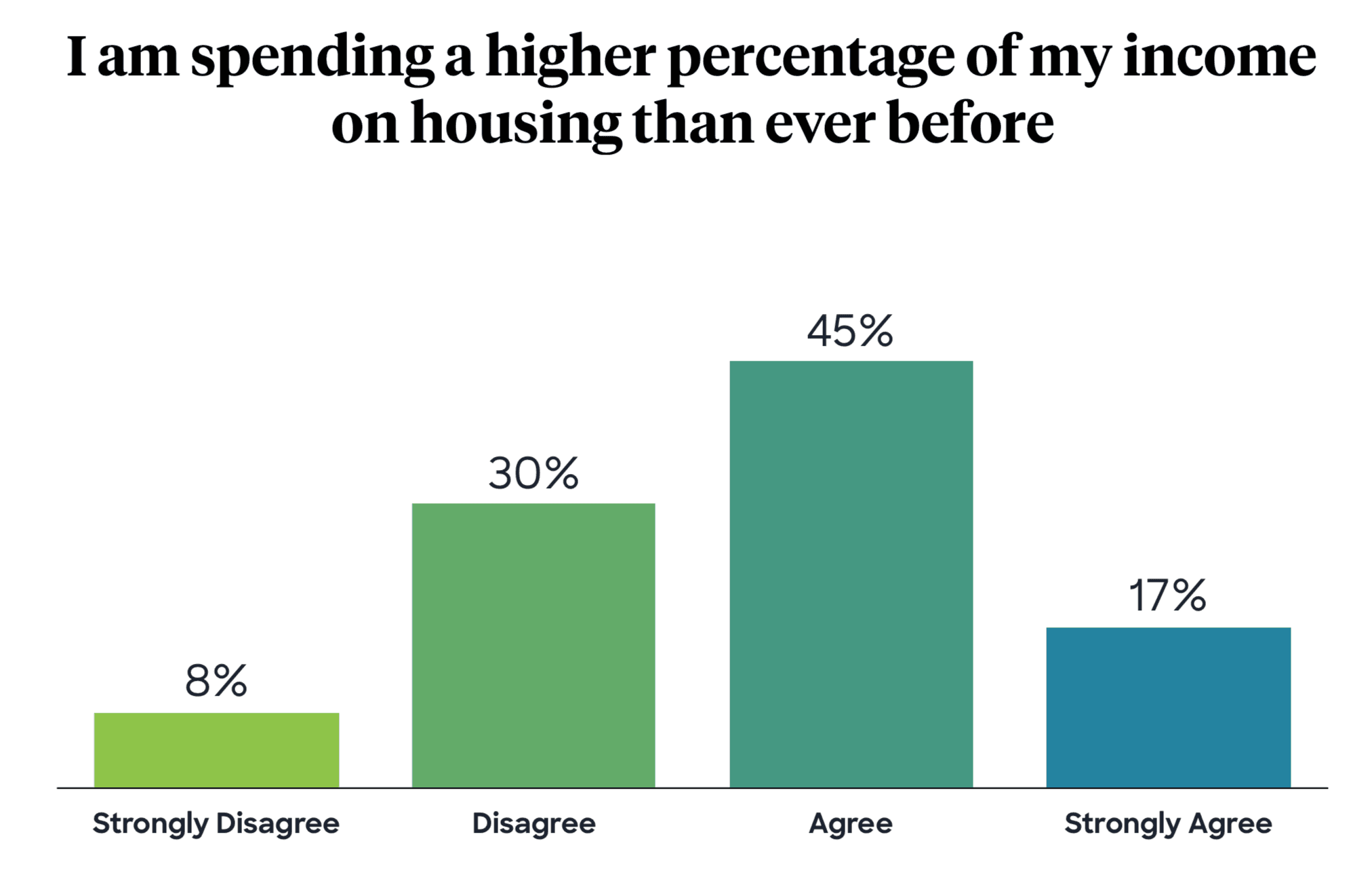

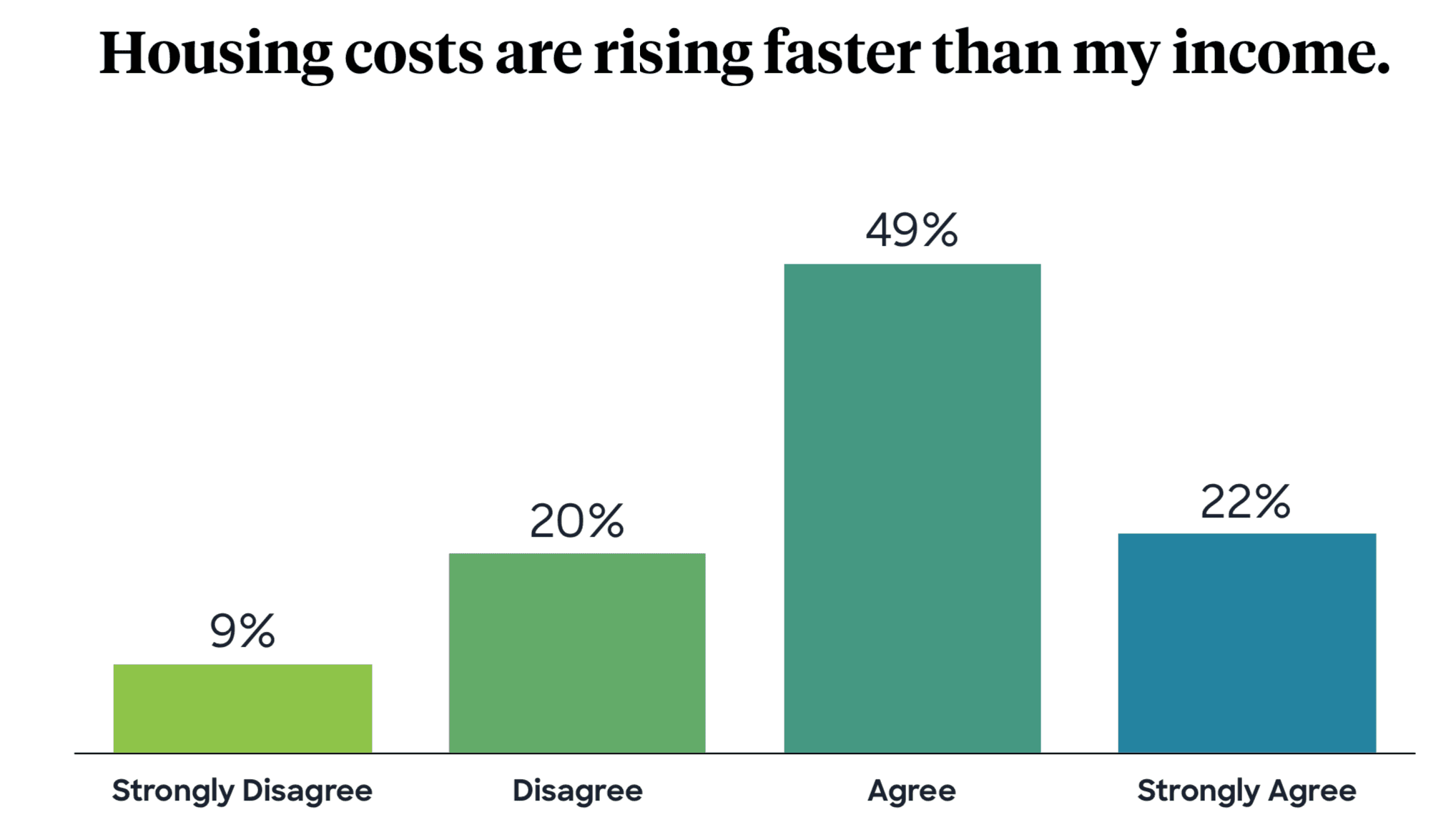

Since its infancy, Hometap has been studying the house-rich, cash poor phenomenon that has been building since the Great Recession. The widening gap between wages and housing costs as well as the lack of attractive options to access home equity is largely to blame for this crisis. In fact, according to our study, 71 percent of Boston-area homeowners report their housing costs are rising faster than their income while 62 percent say they’re spending a higher percentage of their income on housing than ever before.

Why Does It Matter?

Our study of nearly 700 homeowners nationwide aimed to track the impact the house-rich, cash-poor crisis is having on homeowners across the country. What we found when we took a closer look at Boston was that the security of future income, property taxes, and maintenance costs are the greatest sources of this stress.

See the national results of Hometap’s Homeowner Study

Property taxes are a moderate contributor of stress across much of the country, but in certain areas, including Boston, it’s a more significant source of stress (75 percent answered they’re moderately to extremely stressed, compared to only 54 percent nationally).

74 percent expect the gap between wages and housing costs to increase—not an unreasonable fear when you consider what homes are going for today. A 2018 Boston Magazine article claimed that just to rent in Boston requires a minimum annual salary of $78,477 (without roommates). The median household income in the Boston-Quincy area in 2017 was not too far beyond that at $85,691. Bostonians overwhelming answered (73 percent) that they’re moderately to extremely stressed about security of future income—and 15 percent aired on the side of ‘extremely.’

Access Your Equity, Eliminate Homeowner Stress

The vast majority of Boston-area homeowners (88 percent) said they believe they’re building equity in their homes, and there’s a good chance they’re right. Thanks to growing demand to be in Boston, home values are skyrocketing; the Boston Home Price Index increased 118 percent between 2000 and 2018 (compared to a 95 percent increase nationally).

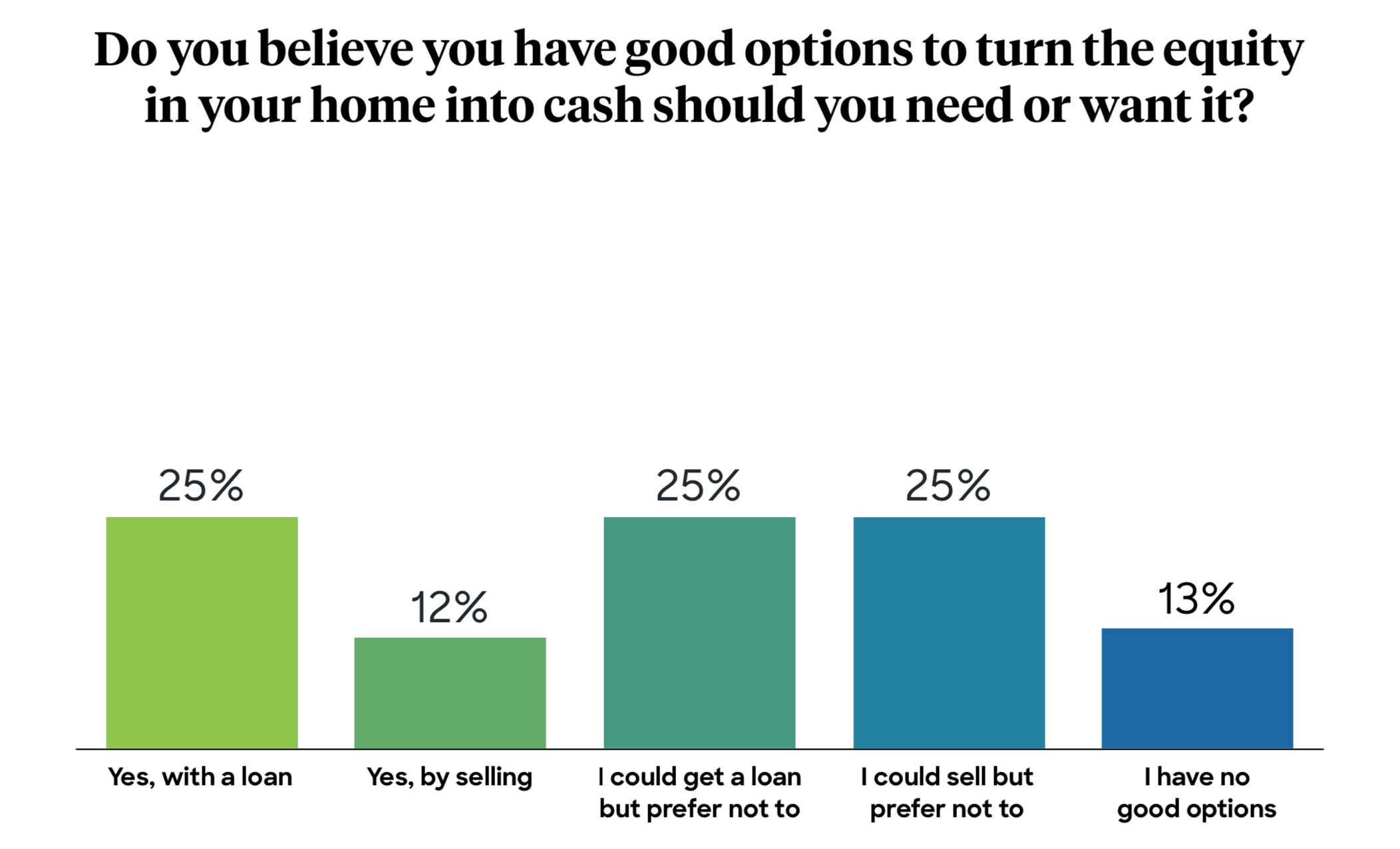

But 64 percent of Boston-area homeowners say high housing costs make it difficult to achieve other financial goals, whether that’s paying off debt, starting a small business, or any number of goals. Nearly as many (63 percent) don’t feel like they have good options for turning the equity in their home into cash.

Twenty-five percent don’t want to take on a loan and the debt, interest, and monthly payments that come with it. Another 25 percent say they could sell their home to access equity but would prefer not to.

As a homeowner, you do have options. You can access home equity via a home equity loan, home equity line of credit (HELOC), cash-out refinance, or home equity investment—and not all of these options involve taking on additional debt.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.

More in “Market insights”

Survey: Homeowners Look for These Three Things in Home Equity Financing

How Should Homeowners React to a Fed Rate Cut?